Let's take back our water

Margaret Thatcher privatised water in England and Wales in 1989 - she couldn’t get away with it in Scotland so they have publicly-owned Scottish Water. Welsh Water is now a not for profit. England has a unique model of privatisation. We didn’t just give private companies a right to operate, we sold off our assets and infrastructure wholesale.

Your private water company has a monopoly in your area and there is no market, you have no choice about the water company you use. Privatisation was supposed to mean lower bills and a better service but the opposite has happened.

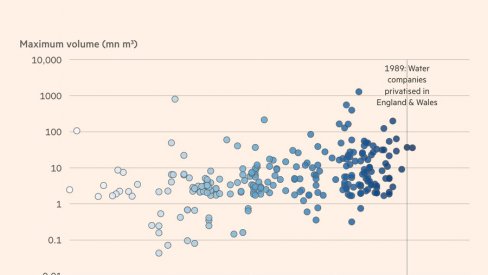

Privatisation is a legalised scam. Since the 1990s, investment from the privatised English water companies has gone down 15%, and they’ve built up a debt mountain of over £60 billion (paid for by us). Meanwhile, shareholders have received £78 billion over the last 35 years.

The privatised English water companies pour raw sewage into our rivers and seas, which kills fish and wildlife and makes people ill. A huge amount of water is leaked away every day. Instead of spending money on infrastructure to tackle sewage and leaks, the water companies prioritise their shareholders. We rely on Ofwat and the under-funded Environment Agency to slap their wrists when it goes wrong.

The English water companies are more than 90% owned by shareholders abroad, for example:

• Wessex Water is 100% owned by a Malaysian company, YTL

• Northumbrian Water is owned by Hong Kong businessman Li Ka Shing

• Thames Water is partly owned by investors from the United Arab Emirates, Kuwait, China and Australia

Read more about water company ownership in England (see table 1)

Welsh Water is a not for profit. Scottish Water and Northern Irish Water are both in public ownership.

- Since privatisation, £72 billion has gone to shareholders - around £2 billion a year on average

- The water companies have built up a debt mountain of over £60 billion and used this to finance dividends for shareholders

- The average pay for a water company CEO is £1.7 million a year. The biggest earner is Steve Mogford, CEO of United Utilities, on £2.9 million

- Our bills have gone up by 40% in real terms since privatisation

- Water companies are leaking away 2.4 billion litres of water a day (up to a quarter of their supply)

- The Environment Agency has said that by 2050 some rivers will see 50-80% less water during the summer months – so water is a precious resource we need to conserve

- Every day, the water companies discharge raw sewage into our rivers and seas more than 1000 times on average - over 9 million hours since 2016

- Only 14 percent of English rivers are considered to have good ecological status

- In Scotland, water is in public ownership. Bills are lower and rivers and seas are cleaner

- Publicly owned Scottish Water has spent £72 more per household per year (35% more) than the English water companies. If England had invested at this rate, an extra £28 billion would have gone into the infrastructure to tackle problems like leaks and sewage

- In France, a number of cities have brought water back into public ownership. They didn’t sell off the assets like England did which means they can just wait until contracts come to an end

- In Paris water came back into public ownership in 2011. The publicly owned company L’Eau de Paris has built still and sparkling water fountains throughout the city!

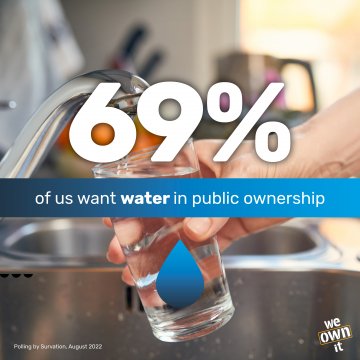

- 82% of the British public want water back in public hands

Can’t regulation fix the problem?

For more on this, see our blog here. However to sum up, we’ve been trying regulation for 34 years, since privatisation in 1989, and it has failed. That’s why we’re in this mess.

Research looking at the role of regulation in water networks confirms “private equity investors have found innovative financial mechanisms for increasing investor returns that are unrelated to productive activity…The regulatory toolbox, governed by a narrative of competition, has consistently been biased towards investors…the regulator is caught in an impossible bind in meeting the contradictory and contested interests of investors, end users and the state”. Not very encouraging.

Regulation has failed for five important reasons:

- Privatised water companies are at no risk of ever losing their monopolies, there is no competition. In fact as it stands, we have to give them an absurd 25 years notice if we want to take back our water.

- Ofwat, the regulator, is hopelessly captured - there’s a revolving door between people working at the water companies and people working in Ofwat. This makes it very unlikely that it will do a good job of holding the water companies to account.

- The Environment Agency is hopelessly underfunded. Its funding has been cut by 50% over the past decade so it’s very difficult for it to hold water companies to account. Staff are not being allowed to do the job of protecting our environment.

- The fines water companies have to pay are too small to have any impact. Water companies see them as the cost of doing business and go ahead and pollute.

- The water companies are set up to prioritise making a profit for their shareholders. This means they are incentivised to invest as little as possible in the infrastructure. They walk away with £1.5 billion in dividends for shareholders every year on average (and £1.7 million for CEO salaries). Instead of having water companies with a public mission and public accountability, these companies have to deliver for their shareholders first, and the rest of us second. Given that stopping sewage requires serious investment, why would we be pouring all this money down the drain? Publicly owned Scottish Water has spent £72 more per household per year (35% more) than the privatised English water companies. If England had invested at this rate, an extra £28 billion would have gone into the infrastructure to tackle problems like leaks and sewage.

Don’t the private companies bring investment?

No – in fact they extract value. As research has highlighted "companies could have afforded to finance all their operations and investments without taking on any debt at all. Instead, evidence suggests their debt taking was driven by overly high dividends". So every penny of the water companies' investment in water infrastructure has been covered by our bills. See our video explainer here too.

The UK was ‘the dirty man of Europe’ before privatisation?

A lot has changed over the past 30 years. Water companies improved their game because of EU law, not because of privatisation. They started out with a green dowry of £1.5 billion from the government. Scottish Water, in public hands, has cleaner rivers and seas.

How could we take back our water and how much would it cost?

Taking back our water means buying back the water companies so they can be publicly owned, like Scottish Water. This isn’t a particularly radical thing to do – in the energy industry the Conservative government removed some duties from National Grid to create a publicly owned Future System Operator to plan for net zero. The new independent National Energy System Operator is set to launch in October 2024. Bringing the privatised English water companies into public ownership would involve a similar process.

Parliament can decide on an appropriate level of compensation for shareholders, depending what it thinks is in the public interest. This decision can take into account, for example, the outrageously bad track record of the water companies - how little they have contributed over the years and how much they’ve already extracted in profit.

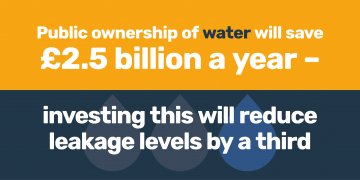

If we gave the shareholders back what they put in (i.e. the equity value of the shares) it would cost just under £15 billion to buy back the water companies. We would save around £2.5 billion a year because we wouldn’t have to pay out shareholder dividends and borrowing costs are lower in the public sector. Bringing water into public ownership pays for itself in around 6 years on that basis.

One option that wouldn't cost the public anything and that we could start right now would be to take shares not fines from water companies when they pollute. This would kick off the process of taking back our water, help clamp down on profiteering polluters, and give local communities more say.

What about pensions?

Over 90% of the English water companies are owned by international investors, private equity funds, and banks. Only 8.5% of shareholders in the water sector are UK pension funds.

Pension managers minimise risk by spreading investment, and small fluctuations in value are normal. The impact on funds is tiny in relation to the investments of each fund as a whole. Even if investors in UK water and energy grids were, in total, notionally ‘losing’ £40 billion short of ‘true market value’, the 0.8% of that ‘loss’ that affects UK pension funds is minimal. As University of Greenwich research outlines, this represents less than 0.1% of the £2,200 billion investments by UK pension funds – much less than the average daily fluctuation in the price of investments. The impact would be invisible.

There are much better ways of supporting UK pensioners - for example, the water companies could reverse their policies of closing their own pension schemes and running big deficits in their pension funds. In general, bringing services into public hands and reducing bills would help pensioners.

Do you believe in public services for people not profit?

Take Thames Water into public ownership

Dear Rt Hon Steve Reed MP, Secretary of State for the Environment, Food, and Rural Affairs and Jonathan Reynolds MP, Secretary of State for Business and Trade,

As Thames Water collapses, we call on you to take it into public ownership, with three conditions:

- No bailout at our expense - the government must use the law to protect billpayers and taxpayers, not the financial institutions that got us into this mess

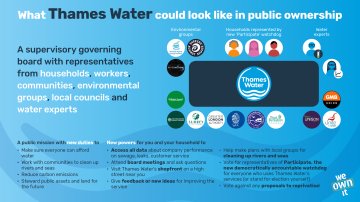

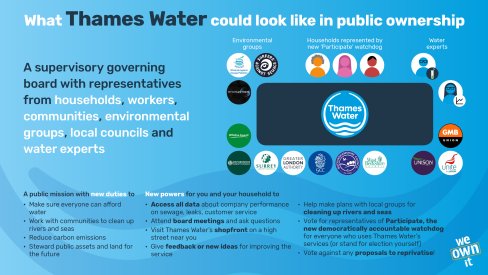

- New publicly owned Thames Water must give communities a role in governance and be accountable for a serious plan to tackle leaks and sewage and clean up our rivers

- Make it permanent not temporary

Last signature: Ian Shrewsbury, 11 hours 37 min ago